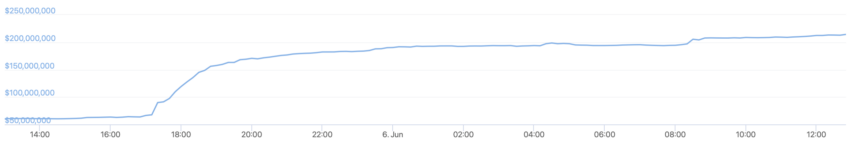

Trading volumes on the Uniswap v3 decentralized exchange (DEX) on Ethereum jumped 87% in the past 24 hours after the US Securities and Exchange Commission (SEC) sued Binance for offering unregistered securities.

Volumes on Ethereum’s Uniswap v3 rose $800 million as markets absorbed the news that the SEC charged Binance and CEO Changpeng Zhao with mishandling customer funds, misleading investors and regulators, and offering unregistered securities.

DeFi Volumes Outpace Centralized Exchanges

After the SEC complaint, Binance recorded over $300 million in net outflow. Net outflow is the difference between the value of assets entering and exiting the exchange.

After the news, volume on Curve, a DEX for stablecoins, spiked 167% to $120 million. Curve DEX allows users to swap stablecoins. PancakeSwap v3, a DEX on BNB Chain, netted a whopping 269% 24-hour gain to reach $215 million.

A decentralized exchange automates markets for cryptocurrency pairs using smart contracts.

The most actively traded pair on Uniswap v3 is wrapped ETH and USDC, while USDT and wrapped BNB dominate PancakeSwap v3. Curve’s most active market is USDC and USDT.

Decentralized exchanges have recently emerged as winners as their centralized counterparts are slowed down by aggressive enforcement and internal processes.

May’s meme coin frenzy saw DEX volumes surpass Coinbase volumes in the first week while centralized exchanges did not offer PEPE, TROLL, BOBO, and other ERC-20 coins.

Click here for a roundup of the best no-KYC crypto exchanges.

Coinbase said it has a rigorous vetting process before listing coins on its exchange. It delisted six altcoins after they failed a March review.

The US exchange also received a Wells Notice from the SEC in March. The notice said that some of Coinbase’s tokens are securities. The agency also refused the exchange’s request to create new rules for crypto.

Binance CEO Wants to Invest in DEX Projects

Before the SEC crackdown, Zhao mentioned in a recent Bankless interview that he would invest in DEXes. He said that while Binance considers transparency important, the firm needs to maintain its partners’ anonymity to mitigate cyber threats.

The SEC asked courts to freeze Binance’s assets shortly after reports surfaced one of its executives operated accounts for its Binance.US entity. The watchdog also alleged that the exchange mishandled customer funds.

“Because of our size and global name recognition, Binance has found itself an easy target caught in the middle of a US regulatory tug-of-war.”

In January, Binance admitted storing user funds with collateral backing B-tokens it mints to streamline blockchain transactions.

The exchange is also fighting a lawsuit filed by the US Commodity Futures Trading Commission which alleged Binance illegally granted US firms access to its derivatives desk.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

The post DEX Volumes Surge After SEC Cracks Hammer on Binance appeared first on BeInCrypto.